this offer has expired!

Student loan debt sucks!

Are you ready to break free from your student loan debt?

I’ll teach you what the student loan industry doesn’t want you to know so you can get out of debt & reclaim your future!

does this sound like you?

You feel stuck because you don’t see a way of of debt & it’s controlling your life

You’re overwhelmed because there’s so much information and you don’t know what actually applies to your situation

You’ve got more expenses than you have money & something else always comes up to throw you off track

You’ve been carrying around shame or guilt because of past money decisions

yes, that's me

it doesn't have to be this way!

imagine how amazing it would be to...

Get the keys to the home your student loan debt made seem impossible for you to qualify for or afford

Relax on your dream vacation that you never thought you’d be able to take because of your debt

Have your money going towards making sure you have enough saved & invested for your retirement.

Get adequate, peaceful sleep because you are no longer burdened with debt

are you ready to go from feeling hopeless & stuck to having an actionable plan to take control of your money &

get out of debt?

Save Time

by avoiding common financial pitfalls and gaining access to proven strategies that streamline your financial decision-making process.

Save Money

with insights into effective budgeting, debt management & payoff, allowing you to maximize your financial resources.

Get Results

you can actually see in your financial life, whether it's reducing debt, increasing savings, or making informed financial decisions that align with your goals.

have we met yet?

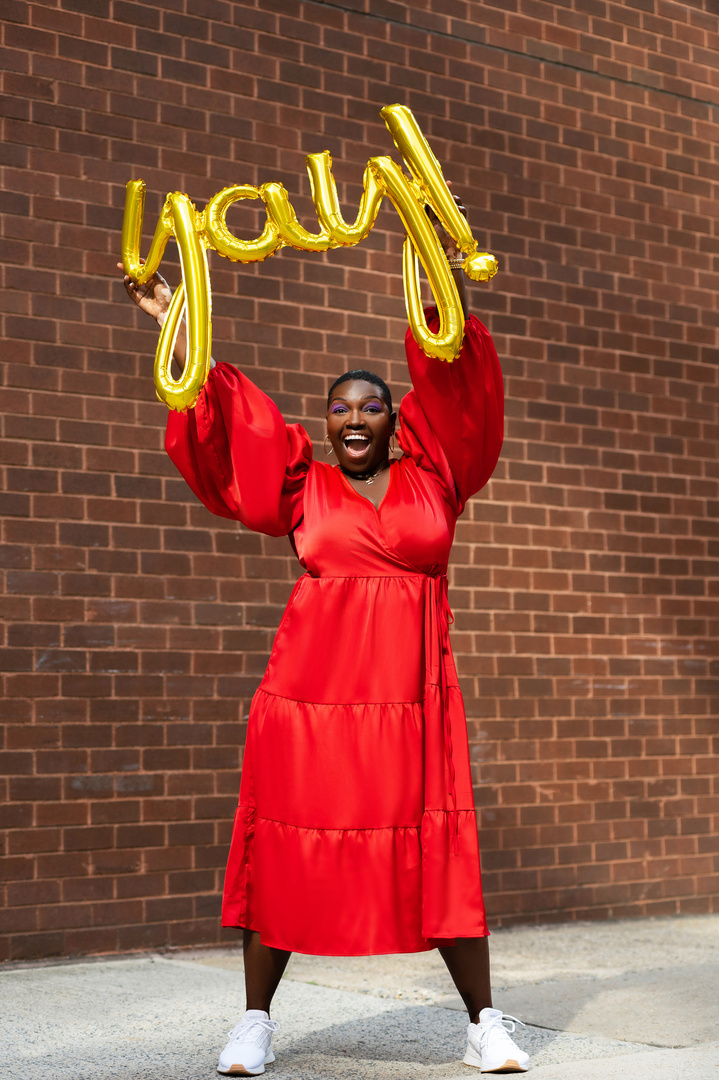

I’m Nika, your new debt-slaying bestie & this is my story:

I am an award-winning debt freedom expert, personal finance content creator, and the Founder of Debt Free Gonnabe LLC.

I teach others how to better manage their money and get out of debt, without sacrificing fun.

By delivering personal finance education in a way that is easily understood, relatable, and judgement-free, I’ve helped my community receive over $1 MILLION in student loan cancellation.

It’s my mission to teach you everything I know to help you escape the student loan debt trap.

Inside BREAK FREE is everything you need to master your money & your student loan debt!

LIFETIME ACCESS

$217,000+ forgiven! Thank you for your voice, journey and platform to EMPOWER families. All I can say is THANK YOU GOD for using you as a vessel to educate.

Vanessa

after the course you will be able to:

Overcome limiting beliefs and develop a positive money mindset.

Gain (or regain) control of money and implement systems to ensure your money works for YOU

Be on your way to demolishing your debt & reclaim your future

Feel confident about your financial decisions & be equipped with the knowledge and tools needed to build a secure financial future.

Sonia

I just wanted to say thank you because you always provide clear, reliable information, breaking down a super cumbersome process in a way that feels less overwhelming.

Travis

All ya boy has is his mortgage! $91,982.04 of total student loans forgiven!

Neve

Thank you for breaking down all of this loan information. I couldn’t have understood it without you. Ugh, my life just got $101,636 lighter!

this is possible for you too!

what's inside

1

Self-Paced Course with 15+ Hours of Video Content

2

Bi-weekly LIVE Group Coaching Sessions

3

Support & Accountability plus Workbooks, Cheat Sheets, Templates, & Guides to help you through your journey

module one

Defining Your Why

In this module, you'll start your journey to financial empowerment by discovering your personal "why" – the driving force behind your financial decisions & goals. Learn to set clear intentions and connect with your deepest motivations to stay focused and committed throughout the course.

module two

Mastering Money Mindset

Transform your relationship with money in Module 2. Explore the psychology of money, identify limiting beliefs, and replace them with empowering thoughts. Cultivate a positive money mindset that will drive your financial decisions and actions.

module three

Budget Like a Boss

Take charge of your finances in Module 3 by learning to create and maintain an effective, real life budget. Discover practical budgeting techniques, tools, and strategies to gain control of your spending, track your income, and allocate resources wisely.

module four

Savvy Saving Strategies

Managing your money, getting out of debt & building wealth requires smart saving habits. Module 4 teaches you the art of saving with purpose. Explore various savings strategies, from emergency funds to long-term savings, get answers to challenges to saving, and uncover the secrets to achieving your financial goals

module five

Increasing, Optimizing, & Diversifying Your Income

Dive into strategies for increasing your income in Module 5. Explore ways to optimize your current sources of income and discover new avenues for earning. Learn about passive income streams.

module six

Demolishing Debt & Reclaiming Control

Debt can be overwhelming, but in Module 6, you'll gain the tools and knowledge to conquer it. Explore debt reduction strategies, prioritize repayment, and develop a personalized plan to eliminate debt and regain control of your financial life

module seven

Decoding Student Loans

Module 7 is all about understanding your student loans inside out. Get a comprehensive overview of the different types of student loans, interest rates, and repayment options. You'll be equipped to make informed decisions about your student loans.

module eight

Breaking Free From Student Loan Debt

In this final module, you’ll learn advanced techniques to accelerate student loan repayment and explore forgiveness and consolidation options. This module empowers you to break free from the burden of student loan debt and embark on a debt-free future.

ENROLLMENT OPTIONS

Valued at $6,783

pay in full

One-time payment of

$797

Afterpay & Klarna Available

Lifetime Access + Future Updates

Workbooks, Scripts, Templates, Quizzes, & Spreadsheets

Private Facebook Group

Live Group Coaching Calls

BONUS: How to Bank Like a Boss

BONUS: How to Improve Your Credit Score

BONUS: Making Sense of Parent PLUS Loans

BONUS: How to Stop the Student Loan Debt Cycle

why choose this course?

1

comprehensive education on multiple aspects of personal finance insuring you have a well-rounded understanding of your finances.

2

skills to transform your relationship with money, replacing limiting beliefs with a positive money mindset that empowers your financial decisions

3

specialized knowledge and strategies to tackle student loan debt effectively, potentially saving you thousands of dollars.

4

guidance to create a financial plan tailored to your unique goals, ensuring you're on the path to financial success

5

practical strategies to increase and diversify your income, giving you more financial security and freedom

6

a step-by-step plan to tackle and eliminate debt, relieving the stress and burden that comes with financial obligations

01.

How is this course different than other financial course?

This course’s approach focuses on practical, actionable strategies tailored to personal finance & student loans. It addresses common gaps and challenges presented in real life & other courses, offering a more engaging, applicable & effective learning experience.

02.

I don’t even know where to start, is this course good for beginners?

This course is designed to accommodate various levels of financial knowledge. It provides a comfortable, step-by-step approach to improving financial literacy, with personalized support to help you every step of the way.

03.

Can’t I just Google this information?

Yes. While free resources are available, this course offers structured, expert guidance & personalized support all in one place. Saving you time & money, & and ensures you receive targeted, effective strategies tailored to your situation

04.

How long will it take to get through the course?

The course it self-paced with a new module being released every 1-2 weeks so you can work at a pace that fits your lifestyle.

OMG!!! $26,828 forgiveness all because of you! You have no idea how these loans have haunted me! Thank you Nika, you have changed countless lives!

Crystal

MOHELA shows $0 from $86,437!

Thank you for the push to see this through. $74k gone!

My student loan debt has been forgiven! $133k GONE!

did someone say bonuses?

VALUE

VALUE

$197

How to Bank Like a Boss

Learn banking services and tools to maximize financial efficiency & success. I’ll also show you how and where to set up your accounts.

$197

value included

VALUE

$297

VALUE

How to Improve Your Credit Score

Learn how your credit score is calculated & different types of credit scoring. Plus get dispute letter templates, & credit score tracker.

$297

value included

VALUE

$197

Making Sense of Parent PLUS Loans

Get a better understanding ofParent Plus loans, loan terms, interest rates, repayment & forgiveness options, & alternatives.

$197

value included

VALUE

$297

VALUE

How to Stop the Student Debt Cycle

Find out ways parents can assist their children in planning for education, cost-effective schooling options & how to manage higher education costs.

$297

value included

Live Bi-Weekly Group Coaching & Replays

Access to a Library of Resources

Dozens of Done For You Templates, Guides, & Cheatsheets

100% risk-free money back guarantee.

If you complete the first 5 modules, including the associated activities, and fully complete the accompanying worksheets, and realize this course is not for you, that it has not helped you set realistic money goals, build a budget, learn to save, or increase your income, and you gave it your maximum effort, you will be provided a full refund of the purchase price.

No refunds will be available after 30 days from the date of purchase.

this is for you if...

You have federal student loans

You want to stop living paycheck-to-paycheck

You no longer want to feel stuck, anxious, defeated or hopeless

You’re tired of having shame or guilt because of past money decisions

You want expert & community support to break free from debt to live the life you want

this is NOT for you if...

You hold debt from other countries

You only have private student loans

You expect your financial situation to magically change

You are unwilling to do the work I outline in the course

You don’t need help paying down your debt and would rather do it alone

ready for results?

LIFETIME ACCESS

Take control of your money and end the paycheck-to-paycheck cycle

Get step-by-step instruction to take you from feeling defeated to defeating your debt

Get guidance from an expert whose been where you are now & support from people just like you

Enroll today!

Break free & start living the life you deserve!